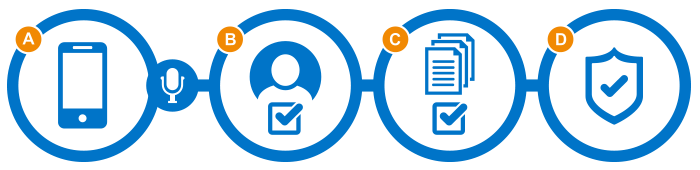

A Quick Overview of How The Loan Process Works

1. Contacting 1st Residential Funding – We are open five days a week, Monday through Friday 8:30 A.M. to 5:30 P.M. and by appointment on Saturdays.

At any time in your shopping process, 1st Residential Funding’s highly skilled loan officers will be happy to assist you in finding the program that best suits your borrowing goals. Our staff is trained to give you straightforward, honest answers that make getting the right loan easy. Whether you want a Good Faith Estimate, or even apre-approval, you never have to leave your home or office. 1st Residential Funding will gather the proper information over the phone and fax or mail the necessary documents directly to you. At this web site, you can check our most recentrates, fees andclosing costs, communicate with our staff through e-mail, or live help, submit apre-approval, and evenapply for a mortgage 24 hours a day, seven days a week.

2. Applying – There is no longer a need to drive to an office and spend hours wasting time. With 1st Residential Funding, you can submit your loan application by phone (1 888 854-RATE) with a loan officer instantly; the process takes about five to ten minutes! You can download and print our Application Package with everything you need at your fingertips. Then you can complete the forms in the comfort of your home and mail it all to 1st Residential Funding 1755 West Broadway Street Suite 2 Oviedo, Florida 32765 or call (1 888 854-RATE) and do it all by phone with one of our knowledgeable loan officers or visit us in person. You can also review the document checklist to see what items we may need to process your loan for final approval. By closing within your designated lock-in period 1st Residential Funding guarantees that the terms (rate and points) of your loan will not change.

3. Confirmation of Application- Once you apply with 1st Residential Funding we can lock in your interest rate or you can choose to “watch” the rates while we process your application, the choice is yours. These rates are updated live daily and if the market changes sometimes twice daily. There are no rate gimmicks, no low ball quotes, and no surprises at closing.

4. Processing – Once our processing center receives your application, a Loan Officer will pre-screen your file based on income and credit worthiness. An Appraiser local to the area will be commissioned to review the property. The original Loan Officer assigned to your file will be your contact for any questions relating to your loan. This is done so you do not have to go through different processors that may not even be familiar with your file. You have access to your loan officer via our live help, phone (1 888 854-RATE), email, or visiting them at our convenient location. Our door is always open and our loan officers are always available to answer your questions. Lower rates and better service is the motto we have earned! Once 1st Residential Funding receives your completed application the file will then be submitted to our underwriters.

5. Underwriting – The decision to approve or deny a loan is based upon several basic factors: employment history, credit, income, debt to income ratio’s, cash savings and property appraisal. At 1st Residential Funding we pride ourselves in offering programs that cover almost any kind of credit history, good or slow credit included. The underwriting process typically takes 2 to 3 days. Your 1st Residential Funding Loan Officer will immediately contact you once your loan is approved.

6. Closing – After you have been approved, 1st Residential Funding will prepare the closing documents that will be supplied to our closing agent. Closings can take place in three business days after loan approval.